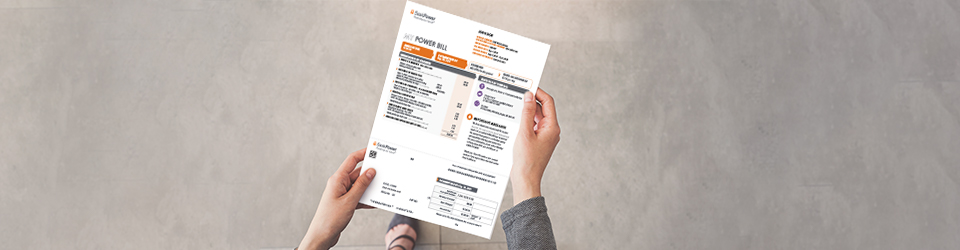

Ever wonder how to read your net metering bill? Let’s take a deep dive into each section of your bill to better understand your charges, taxes and credits.

What you paid on your last bill. If you owe money from your previous bill, it shows it here.

This is your meter reading for this month and last month. The difference between the two is the amount of power you used (in kilowatt hours).

This section also tells you whether an actual read of your meter or an estimate is being used.

Your solar installation generates power. This is to be used by you first, which reduces the amount of power you consume from the grid. If you produce more power than you need – the excess power generated goes through your bi-directional meter. You receive credit for it here.

If you enrolled in Net Metering before November 2019, you receive one kWh credit for each kWh of excess power generated. This is registered on your bi-directional meter.

The “previous generated electricity” amount is kWh “banked” from past months:

- If you consume more power in the current month than you generate, the net amount will decrease (as displayed above).

- If you consume less power in the current month than you generate, the net amount will increase.

The Federal Carbon Tax is charged if your monthly consumption is greater than the amount you generated or have banked in “previously generated electricity.”

All SaskPower customers pay a basic monthly charge based on their rate category.

If your power consumed is offset by power generated or offset with previously generated power “banked”, no power consumed amount will be displayed under “total electrical charges” except for the basic monthly charge.

Municipal Surcharge Tax is charged at 10% of the total amount of Electrical Charges.

GST is calculated at full amount of Electricity Consumed = kWh X (your rate) X GST 5% + Basic monthly charge X GST 5%.