As of April 1, 2025, the Government of Saskatchewan is pausing the industrial carbon tax in the province. That means SaskPower will stop charging the Federal Carbon Tax on that date. This change applies to all customers.

We expect removing the Federal Carbon Tax will save the average residential customer approximately $112 per year, while farms can expect to save $330 per year.Federal Carbon Charges and Your Power Bill

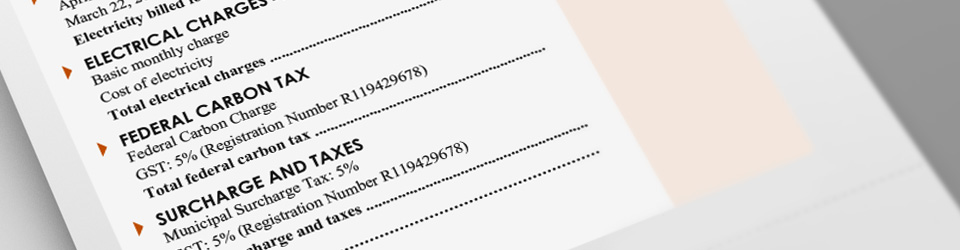

The Federal Carbon Tax will be reduced to $0/kWh starting April 1, however bills reflect power usage during the course of the previous month. This means customers will see a Federal Carbon Tax charge on their April bills for power they used before that date.

Customers who are billed quarterly will only be charged the Federal Carbon Tax for power consumed before April 1. Payment amounts for customers on equalized payment plans (EPP) will be automatically decreased.Saskatchewan Electric Heat Relief

Like all other customers, SaskPower customers who qualified for Carbon Tax Electric Heat Relief this winter will have the Federal Carbon Tax completely removed.

Learn more: